As governments across the globe begin adopting digital tax administration, UAE e-invoicing has become a standard procedure globally rather than a requirement in a region. However, Peppol e-Invoicing is one of the most significant frameworks that ensure international e-invoicing is successful. As UAE companies engage in international trade, knowledge on how Peppol operates in combination with e-invoicing UAE law is becoming fundamental.

Starting with a brief introduction, this guide describes what Peppol is, operates, and does in relation to international business transactions in line with current e-invoicing trends in the UAE.

What Is Peppol e-Invoicing?

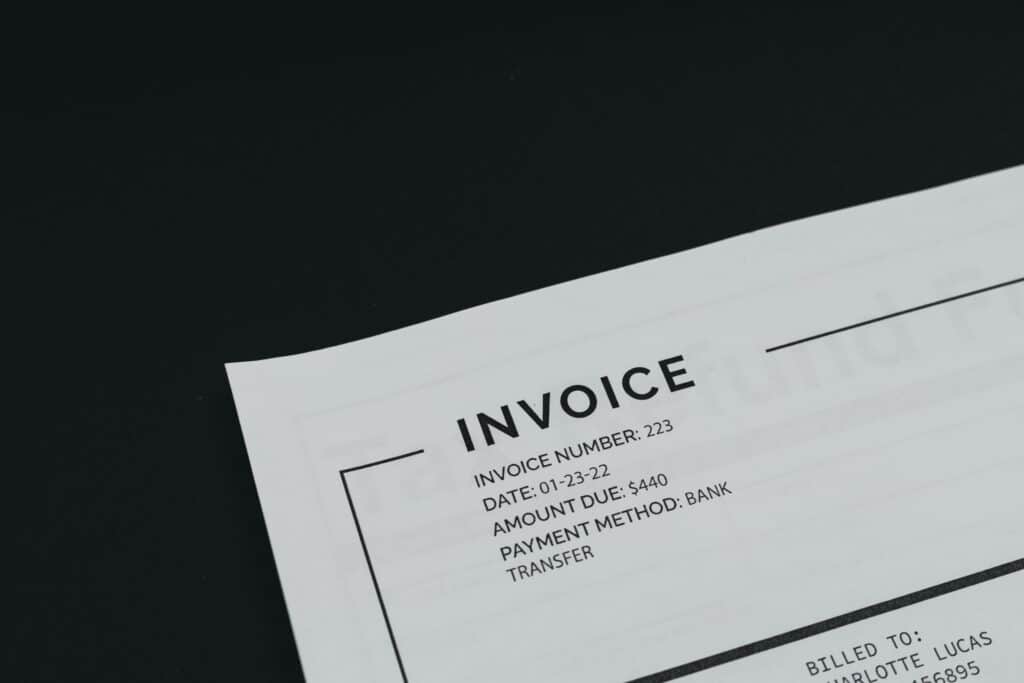

Peppol e-Invoicing is the electronic invoicing that takes place through the Peppol network, which stands for Pan-European Public Procurement Online. It is a secure and standardized method that allows businesses and public authorities to exchange electronic invoices and procurement messages.

Unlike to traditional invoice processes, Peppol ensures that:

- Structured

- Machine-readable

- Secure

- Interoperability – within and across countries

This is because the approach is actually in line with the goals that digital invoicing UAE and other international e-invoicing systems being adopted by tax authorities worldwide.

How Does the Peppol Network Work?

Rather than going in-depth on the technicalities, it’s important to understand the concept behind the network. Peppol is based upon a ‘Four Corner Model’. This model aims for easier communication between the buyer-seller interfaces.

Under this model:

- Businesses access certified Peppol access points

- Documents are exchanged through secured modes using standardized formats

- Each part is identified using a unique Peppol ID

It corresponds to the logic of the UAE E-Invoicing System, since formats, secure transmission, and traceability are essential elements in the framework of the e-invoicing UAE regulation.

Why Peppol Matters for Global Business Transactions?

When it comes to companies transacting across international borders, the challenge of invoice compatibility can often become a major one. Varying norms regarding the invoicing format, validation, and reporting are present in different countries. However, the challenge of invoice compatibility can be dealt with by “Peppol e-invoicing.”

Key advantages include:

- Less manual processing of invoices

- Faster processing of invoices

- Reduced risk of rejected invoices

- Enhanced Adherence Across Jurisdictions

With the UAE promoting its digital invoice mandate UAE, Peppol provides a positive example of how international compatibility can be realized alongside local taxation regulations.

Relationship Between Peppol and e-Invoicing in UAE

Although Peppol is not required under e-Invoicing UAE laws at the moment, it is aligned to a great extent with the approach laid down by the Ministry of Finance and the Federal Tax Authority.

The UAE framework centers on:

- Formats for structured invoices

- Secure transmission

- Audit-ready records

- Well-informed compliance

These are also core in e-invoicing compliance models used across UAE, including that of Peppol, that are applied worldwide. Companies that have systems that are Peppol ready are better positioned for changes in the applicability requirements for UAE e-invoicing.

Peppol Invoice Structure and Standards

One of the important things concerning Peppol is the standardized invoice structure. The invoices shared over the network will follow a strict data model to ensure consistency and validation.

Some common features on a typical Peppol invoice include the following:

- Seller and buyer identification

- Tax and VAT information

- Line-level invoice data

- Currency and totals

- Digital validation checks

By being a lot like FTA XML invoice rules, this structured approach supports long-term e-invoicing compliance UAE strategies.

Benefits of Peppol e-Invoicing for UAE Businesses

The UAE companies that deal with global clients or with governments internationally will benefit immensely with the adoption of the Peppol approach.

Practical benefits include:

- Easier compliance with foreign invoicing regulations

- Faster payment cycles

- Reduced administrative overhead

- Improved data accuracy

With the advent of e-invoicing in the UAE, these global standards would enable companies to future-proof their billing systems in order to seamlessly adjust to the changes caused by these new regular frameworks.

Security and Authentication within the Peppol Framework

A key pillar of Peppol is security. In its network, all transactions are authenticated, encrypted, traceable, and secure.

Security controls are composed of:

- Verified access points

- Sender and receiver authentication

- Secure document transmission

- Full audit trails

Such best practices are based on the same guidelines as those set forth under the e-invoice security & authentication UAE, hence ensuring greater reliability between the businesses and the tax authorities.

Pepol and VAT / Tax Compliance

In terms of taxation, Peppol facilitates:

- Correct VAT reporting

- Reduced fraud risks

- Enhanced audit readiness

- Transparent transaction records

These results meet the aims that UAE tax compliance services seek, as well as the broader trend for digitized tax administration, achieved through e-invoicing UAE law.

When Should UAE Businesses Consider Peppol?

Peppol might be especially useful for you if:

- Trading with EU or Peppol-enabled countries

- Supplies government or public sector bodies in foreign countries

- Is an upgrade of ERP systems or invoicing systems necessary

- Envisions long-term relevance with worldwide e-Invoicing systems

Early adoption can help cut future costs of compliance as well as simplify international invoice processing.

How Professional Guidance Helps?

To fully implement Peppol or integrate it with the e-invoicing UAE law, one needs both technical and legal clarity. It is at this point where advisory expertise has proved to be fundamental.

Firms such as HH and Hale offer their customers assistance in:

- Assessing invoice system readiness

- Standardizing global invoice formats based on UAE requirements

- Providing advisory on e-invoicing consultation UAE and system selection

- Enabling the integration of support for corporate tax and VAT

The focus must not be solely on technology adoption, but on sustainable and audit-ready compliance as well.

Conclusion

Peppol e-invoicing is more than a European affair, it is the worldwide trend in digitalized invoice. As the UAE continues on with implementing a structured e-invoicing UAE law in place, international trade-related companies must recognize where Peppol falls in this realm of adherence.

Implementing globally interoperable billing systems today will decrease friction in the regulatory environment of tomorrow.

Need Expert Guidance on Peppol and UAE E-Invoicing?

As international e-invoicing standards such as Peppol e-Invoicing go on to influence world trade, UAE businesses need to work toward keeping their invoicing systems relevant and in step with both global frameworks and e-invoicing UAE law.

HH and HALE provides organizations with readiness assessments of their invoice systems, Peppol-based process alignments with the UAE E-Invoicing System, and ensures compliance with FTA requirements in the long run.

Whether cross-border transactions or readiness for impending digital invoicing requirements in the UAE, expert guidance will facilitate steering clear of costly adjustments later on.

Talk to our e-invoicing consultants today and understand how Peppol can fit into your UAE compliance strategy.

FAQs

What is Peppol e-Invoicing?

PEPPOL e-Invoicing is a standardized electronic invoice framework that enables the secure cross-border exchange of structured invoices between businesses and governments via certified access points

Is Peppol mandatory under e-invoicing UAE law?

Currently, Peppol is not mandated under e-invoicing UAE law. However, the structured format and secure transmission model of Peppol closely aligns with the UAE’s digital invoicing direction and may further support future compliance readiness.

Can UAE businesses use Peppol for international invoicing?

Yes. The UAE companies conducting cross-border business can rely on the use of the Peppol e-Invoicing system to send and receive invoices even internationally, especially where the use of the system is already mandatory.

How does Peppol differ from the UAE E-Invoicing System?

Peppol is a worldwide interoperability network, but the UAE E-Invoicing System is a nationally governed environment regulated by the Ministry of Finance and FTA. Although these systems differ with respect to their scales, they use data efficiency, safe transmission, as well as auditability.

Do Peppol invoices support VAT and tax compliance?

Yes. Peppol invoices are designed to accurately acquire VAT and taxation information, ensuring that it meets all the required standards in relation to digital invoicing in the UAE.